Insurance Policy Gst Rate

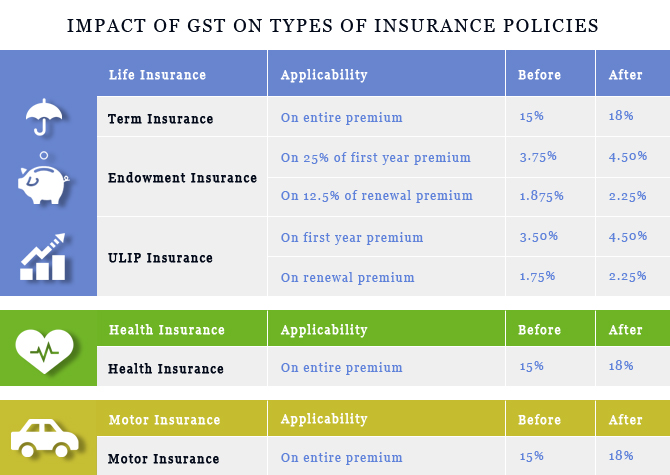

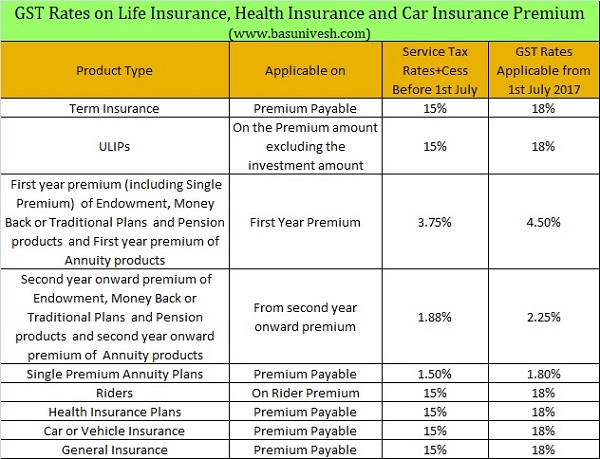

2202020 This changes the applicable GST rate on different policies. If you pay a premium of Rs 10000 on your endowment plan you pay Rs 450 GST in first year and Rs 225 in all subsequent years.

Gst Rates 2020 Complete List Of Goods And Services Tax Slabs

Gst Rates 2020 Complete List Of Goods And Services Tax Slabs

Subsequently for renewal premiums it will be halved of the first year rate which is 225.

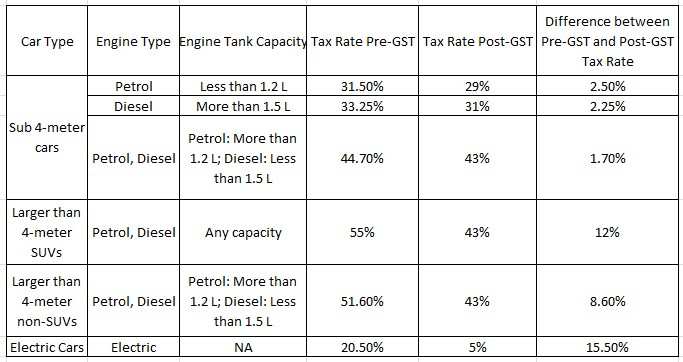

Insurance policy gst rate. 8252018 When the GST Act came into effect the tax rates for the insurance sector were frozen at 18 an increase from the then existing service tax rate of 15 for all policyholders those looking for new policies as well as those renewing existing policies. An 18 tax rate is now applicable on most insurance policies premiums. The hike in the GST from 15 percent to 18 percent would increase the premium of purchasing a new as well as renewing an existing insurance policy.

Let us try to understand the impact of GST on life insurance premiums a. That is you have to spend a significant additional amount in the form of GST while depositing the premium. New GST rule is to be followed by those who are looking for new insurance policies or renew their existing policies.

GST rate will be 225 on your premium. Therefore both life and general insurance policies will have tax levied as per GST at 18. For instance if your premium is 20000 GST at 18 will come to 3600 and you will be paying a total premium of 23600.

According to experts the tax benefit can be claimed on any charge on this GST or on premium. GST on insurance premium ranges from 25 percent to 18 percent. This paper provides an overview of the treatment of general insurance under the GST.

Earlier the tax rate stood at 15. GST rate on bank service charges is 18 which is costlier for the customers. It reflects a no growth at all in the last a few years.

All other insurance which will be referred to as general insurance is fully taxable at the GST rate of 10 per cent. However now service tax is replaced with GST rates. So there has been an increase of 3 than earlier tax rate or a 300 basis point rise in the cost of insurance.

12222019 GST of 18 is charged on term policies which are the cheapest form of insurance as they only carry the mortality cost In the case of traditional. The revisions in the tax rates on insurance policies are as under. Speaking of insurance buying health insurance holds great significance in securing an individuals well-being.

6232020 Before implementation of Goods and Service Tax GST service tax was charged at the rate of 15 on most of the Insurance plans whereas now GST is charged at the rate of 18 on majority of insurance plans. For term plans this translates into a hike of 3. 10102017 GST Rates on Life Insurance Health Insurance and Car Insurance Premium Earlier for the insurance premium you used to pay service tax based on the product you buy.

1182020 GST on Life Insurance Policies Traditional Policies like endowment plans The GST rate is 45 for the first years premium and 225 on all subsequent years premium. 2192019 For single premium policy or endowment insurance plan GST for first year premium amount has been increased from 375 to 45. The impact of GST on life insurance was to put it briefly that these policies will have a tax levied as per GST at 18.

Hence there has been hike in the tax on Insurance services. Tax benefit for GST paid on insurance premiums In the case of health insurance policies you need to pay GST at the rate of 18. 222021 Both general insurance policies and life insurance policies levy GST 18.

The Premium Deciding Factor. 11282017 GST rate on all types of insurance policies is 18 which will increase insurance premium cost. 592020 After the introduction of the GST regime the service tax has been revised upwards and it stands at 18 now.

The insurance sector demands for reduced GST rate 18 to. GST on health insurance includes service tax that tends to affect. 212 rows GST July 1 2017 onwards Term Policy.

8122017 You can refer to the following table to note the impact of GST on your insurance premiums. Life insurance reach in India has reduced from 46 percent in the year 2009 to 26 percent in the year 2016. This will affect the premium rates of the insurance policies as they are largely affected by the service tax rate.

Gst Rates For Lic Policies And Other Insurance Premiums

Gst Rates For Lic Policies And Other Insurance Premiums

Gst Rate On Health Insurance Premium Rating Walls

Gst Rate On Health Insurance Premium Rating Walls

Gst On Two Wheeler Gst Effect On Two Wheeler Price Liberty General Insurance

Gst On Two Wheeler Gst Effect On Two Wheeler Price Liberty General Insurance

Life Insurance Premium Deduction U S 80c Simple Tax India

Life Insurance Premium Deduction U S 80c Simple Tax India

Gst Rate On Health Insurance Premium Rating Walls

Gst Rate On Health Insurance Premium Rating Walls

Gst Rate On Health Insurance Premium Rating Walls

Gst Rate On Health Insurance Premium Rating Walls

Gst Rate On Health Insurance Premium Rating Walls

Different Gst Rates Are Applicable To Different Life Insurance Plans

Different Gst Rates Are Applicable To Different Life Insurance Plans

Gst Rate Changes On Services With Effect From 25 01 2018

Gst Rate Changes On Services With Effect From 25 01 2018

Gst Rates On Life Insurance Health Insurance And Car Insurance Premium Basunivesh

Gst Rates On Life Insurance Health Insurance And Car Insurance Premium Basunivesh

What Is The Rate Of Gst On Lic Premium Quora

What Is The Rate Of Gst On Lic Premium Quora

Gst Rate On Health Insurance Premium Rating Walls

Gst Rate On Health Insurance Premium Rating Walls

What Is The Rate Of Gst On Lic Premium Quora

Current Service Tax Rate On Property Rating Walls

Current Service Tax Rate On Property Rating Walls

Gst Rate Changes On Services With Effect From 25 01 2018

Gst Rate Changes On Services With Effect From 25 01 2018

Gst Impact Insurance Mutual Funds Banks Hotel Restaurants Travel

Gst Impact Insurance Mutual Funds Banks Hotel Restaurants Travel

Gst Rates 2020 Complete List Of Goods And Services Tax Slabs

Gst Rates 2020 Complete List Of Goods And Services Tax Slabs

Gst Rate On Composite Supply And Mixed Supply Simple Tax India

Gst Rate On Composite Supply And Mixed Supply Simple Tax India

Post a Comment for "Insurance Policy Gst Rate"