Insurance Levy 2021

Below is a cropped picture of the Ministrys outlined use of the levy. As policyholders must pay the levy with each premium payment the levy will be collected when premium is paid.

The Rebate Adjustment Factor for 2021 is 0982 and the industry weighted average premium increase for 2021 is 274 per cent.

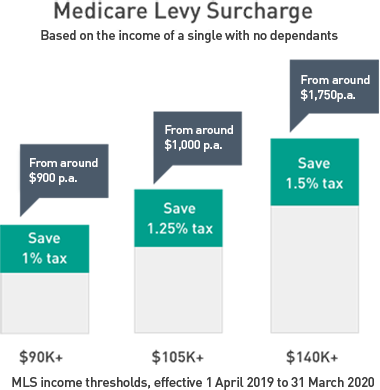

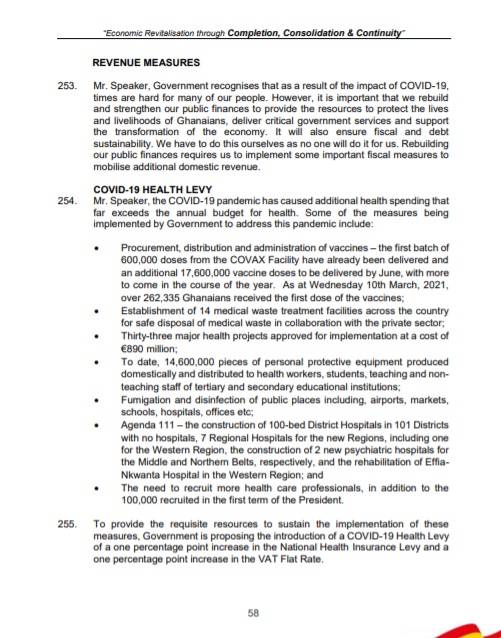

Insurance levy 2021. 3152021 This is to say that the hitherto 25 NHIL charge on goods and services has increased to 35. The Medicare Levy Surcharge MLS is a levy paid by Australian tax payers who do not have private hospital cover and who earn above a certain income. In principle the ZVW is paid by the employer.

This amount varies per health care insurance company average 2021. This is to say that the hitherto 25 NHIL charge on goods and services has. For Quarter Ending June 30 2021 Due July 31 2021 You must submit this form even if you have no transactions to report in this period.

1 day ago However on Friday March 19 2021 the Ministry of Finance on behalf of the government released a detailed clarification of how the government intends to use the Covid-19 levy. The private health insurance rebate is income tested and applies to hospital general treatment and ambulance policies. Generally the amount of levy payable for.

3162021 Unless otherwise stated these figures apply from 6 April 2021 to 5 April 2022. 112018 The levy is calculated as a percentage of premiums on insurance policies. PAYE tax and Class 1 National Insurance contributions You normally operate PAYE as part of.

The current income threshold is 90000 for singles and 180000 for couples and. General Information print or type Firm number. Minister of Parliamentary Affairs and Majority Leader in.

3162021 16 March 2021 724am Government has announced a one per cent increment in the National Health Insurance Levy NHIL. You may get a reduction or exemption from paying the Medicare levy depending on your and your spouses circumstances. In addition the employee should pay a fixed contribution per year the so-called nominale premie per adult.

112021 The contribution ZVW Health Insurance Act is paid on a maximum amount of 58311 on an annual basis. The levy is a percentage of the premium payable with a cap applied per policy per policy year. From 1 April 2020 to 31 March 2021 both dates inclusive 0085 85 From 1 April 2021 onwards date inclusive 0100 100 For insurance policies issued under the HKMCAs life annuity scheme levy will be borne by the HKMCA until further notice.

The Levy starts at 004 in 2018 and increases over four years to 01 in 2021. This is to say that the hitherto 25. The Medicare levy is 2 of your taxable income in addition to the tax you pay on your taxable income.

The rates to apply are set out in the below table. 3152021 As part of revenue measures to help recover Ghanas economy government has announced a one percent increment 1 in the National Health Insurance LevyNHIL. 1182021 Mass tourism to return again in 2021 with 10 million visitors targeted and full insurance cover with arrival levy Tourism levy to be announced in the Royal Gazette shortly and will provide full medical coverage to all foreign tourists in Thai hospitals including Covid-19.

You need to consider your eligibility for a reduction or an exemption separately. Regular payday on Friday 2 April 2021 tax year 2020 to 2021 but paid on Tuesday 6 April 2021 tax year 2021 to 2022 may be treated for PAYE and National Insurance. 2102021 The NHIS is funded by the National Health Insurance Levy NHIL which is a 25 percent levy on goods and services collected under the Value Added Tax VAT 25 percentage points of Social Security and National Insurance Trust SSNIT contributions per month returns on National Health Insurance Fund NHIF investments and premium paid by.

Sole practitioners may enter their Law Society number Name of. Insurance policies to which the Levy applies The Levy applies to policies with policy periods commencing on or after 1 January 2018 whether the policy is a new policy or a renewal policy. 3162021 As part of revenue measures to help recover Ghanas economy government has announced a one percent increment 1 in the.

2 days ago The newly approved COVID-19 Health levy which will see the VAT Flat rate as well the National Health Insurance Levy COVID-19 Health Levy not to defray cost of free water electricity -. The levy rate starts at 004 of the insurance premium per policy year and will adjust gradually to 01 according to legislation.

Gallery Of Sunshine Insurance Finance Plaza Woods Bagot 20 In 2021 Architecture Exterior Architecture Modern Architecture

Gallery Of Sunshine Insurance Finance Plaza Woods Bagot 20 In 2021 Architecture Exterior Architecture Modern Architecture

Government Incentives To Get Health Insurance Medibank

Government Incentives To Get Health Insurance Medibank

Mass Tourism To Return Again In 2021 With 10 Million Visitors Targeted And Full Insurance Cover With Arrival Levy Thai Examiner

Mass Tourism To Return Again In 2021 With 10 Million Visitors Targeted And Full Insurance Cover With Arrival Levy Thai Examiner

Levy On Health Insurance Still Being Imposed By Government Independent Ie

March 2021 Levy Lakeland Joint School District 272

March 2021 Levy Lakeland Joint School District 272

Local Finance Experts Share Advice At Jbiz S Your Finances Your Future Virtual Event Jmore

Local Finance Experts Share Advice At Jbiz S Your Finances Your Future Virtual Event Jmore

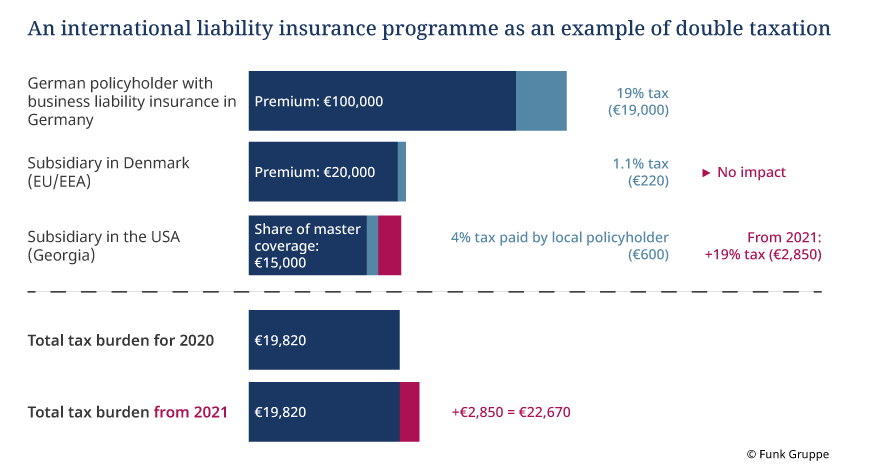

Reform Of The German Insurance Tax Act Funk Gruppe

Reform Of The German Insurance Tax Act Funk Gruppe

Kaiser Story Re Ad Spending For Colorado Health Exchange In 2021 Health Insurance Companies Health Insurance Plans Health Insurance

Kaiser Story Re Ad Spending For Colorado Health Exchange In 2021 Health Insurance Companies Health Insurance Plans Health Insurance

Reform Of The German Insurance Tax Act Funk Gruppe

Reform Of The German Insurance Tax Act Funk Gruppe

The Private Health Insurance Rebate Explained Iselect

The Private Health Insurance Rebate Explained Iselect

Private Health Insurance Rebate Navy Health

Reform Of The German Insurance Tax Act Funk Gruppe

Reform Of The German Insurance Tax Act Funk Gruppe

Kentucky League Of Cities Infocentral

Kentucky League Of Cities Infocentral

School Fees Golden Grove Lutheran Primary School

School Fees Golden Grove Lutheran Primary School

Munich Re Us President Ceo To Retire In 2021 Successor Named Reinsurance News

Munich Re Us President Ceo To Retire In 2021 Successor Named Reinsurance News

Post a Comment for "Insurance Levy 2021"