Is Unemployment Insurance Fraud A Felony

Being charged with this type of fraud in Los Angeles can have a significant impact on your freedom and life. Either way unemployment fraud can be charged as a felony and may carry jail time years of prison or a fine of up to 20000or more in some cases.

Unemployment Fraud More Illinois Residents Receiving Unemployment Benefits From Different States Despite Not Applying For Them Abc7 Chicago

Unemployment Fraud More Illinois Residents Receiving Unemployment Benefits From Different States Despite Not Applying For Them Abc7 Chicago

Forfeiting future income tax refunds.

Is unemployment insurance fraud a felony. The Simmrin Law Group knows how to help. Depending on the amount of money involved the offense levels differ. Making a false statement to obtain a benefit payment is a criminal charge in Wisconsin.

12152020 States like Texas routinely prosecute unemployment fraud at the felony level while states like California and Utah might base your charges on the amount you fraudulently claim. In 2011 the Unemployment Insurance Integrity Act was passed to require states to enhance penalties for fraudulent unemployment claims. If a person is found guilty of unemployment insurance fraud either on the employee or employer side this is a serious offense.

As mentioned earlier unemployment insurance fraud is a severe offense in California punishable by lengthy prison terms and hefty fines. Penalties for UI fraud conviction under the overall Insurance Fraud law Section 550 of California Statutes Again you can either get a misdemeanor or a felony conviction under this law if you are found guilty of UI fraud in California. It involves acts of concealment and deceit to acquire money unlawfully.

This all depends on the defendants criminal history and the circumstances surrounding the particular charge s and the prosecutors discretion. 6182020 Unemployment insurance fraud is a serious criminal offense in the State of Arizona. If you have been charged with unemployment insurance UI fraud you could be subject to serious penalties.

If you have been charged you need to speak with a Los Angeles unemployment insurance fraud lawyer. 6102015 Withholding or giving false information to obtain unemployment insurance benefits is a serious offense that can result in criminal prosecution. Depending upon the circumstances you may be facing a felony charge.

For the offense of unemployment insurance fraud to be charged like a felony the total sum of the supposed scam should be more than nine hundred and fifty 950 dollars or the said amount in a period of one 1 year continuously. Unemployment insurance fraud is a wobbler meaning it can be prosecuted as either a felony or a misdemeanor depending upon the facts of the case ones age ones criminal history and ones employment history. As a misdemeanor the maximum sentence is a year in county jail and 25000 fine.

Unemployment insurance fraud california long beach criminal defense lawyer This offense is defined in California 2101 UIC and can be charged as either a misdemeanor or felony depending on the amount of unlawful compensation received. This is a Class 6 felony where someone misrepresents or fails to disclose facts or makes false statements to get or increase their unemployment insurance benefits. Employers Commit Unemployment Insurance Fraud When They.

The nature of penalties an offender receives is contingent on the exact type of fraud for which they have been convicted the facts of their case and their criminal history. In some cases a defendant may arrange to pay restitution in exchange for the EDD not filing criminal charges. There are both state and federal penalties for fraud crimes.

Unemployment insurance fraud is a wobbler offense meaning it can be charged as wither a misdemeanor or a felony. Losing the ability to ever collect unemployment benefits or unemployment insurance in the future. That means UI fraud is a wobbler offense and the court can decide whether to charge you with a felony or a misdemeanor.

You could face a lengthy sentence and pay a hefty fine. You could be charged with insurance fraud crimes under Article 176 of the NY Penal Code identifying insurance fraud crimes. The crime of unemployment insurance fraud attracts different forms of punishment depending on the amount of money you receive fraudulently and past criminal history.

Lie about why an employee is no longer working for them saying he or she was fired or they quit when in fact the employee was laid off. Unemployment fraud cases can involve an employee or an employer. The following are potential penalties in the state of California.

With a fraud overpayment you are assessed a penalty in the amount of 30 percent of the amount of the overpayment and a false statement disqualification of 5 to 23 weeks. Unemployment insurance fraud is a non-violent white-collar crime. In offenses involving less than 250000 the charge is a misdemeanor punishable by 9 months jail and 1000000 in fines.

Lie about the wages hours or other information concerning a former employee that would potentially increase his or her unemployment insurance benefits. For example in California prosecutors may convict you for a felony and put you in jail if the amount you fraudulently claim exceeds 950.

Unemployment Insurance Fraud Charges In Arizona Shah Law Firm

Unemployment Insurance Fraud Charges In Arizona Shah Law Firm

Local Man Charged With 117 Felonies In Unemployment Benefits Fraud Case

Local Man Charged With 117 Felonies In Unemployment Benefits Fraud Case

What Is Unemployment Fraud Craighead Law Firm

What Is Unemployment Fraud Craighead Law Firm

Greene County Woman Faces Felony Charges For Unemployment Fraud News Dailyfreeman Com

Greene County Woman Faces Felony Charges For Unemployment Fraud News Dailyfreeman Com

Orlando Unemployment Compensation Fraud Defense Attorney

Orlando Unemployment Compensation Fraud Defense Attorney

10 People Facing Felony Charges Related To Unemployment Insurance Fraud

10 People Facing Felony Charges Related To Unemployment Insurance Fraud

Florida Deo On Twitter Did You Know Reemployment Assistance Fraud Is A Third Degree Felony And Can Result In Serious Consequences Learn More About Reemployment Assistance Fraud And How To Prevent It

Florida Deo On Twitter Did You Know Reemployment Assistance Fraud Is A Third Degree Felony And Can Result In Serious Consequences Learn More About Reemployment Assistance Fraud And How To Prevent It

Fraud Or Mistake Claimants Say Unemployment System Punishes Confusion

Fraud Or Mistake Claimants Say Unemployment System Punishes Confusion

Los Angeles Unemployment Insurance Fraud Attorney Unemployment Insurance Fraud Lawyer Leah Legal Criminal Defense

Los Angeles Unemployment Insurance Fraud Attorney Unemployment Insurance Fraud Lawyer Leah Legal Criminal Defense

Power Sector Fraud Efcc Investigates Collusion To Dupe Ibadan Disco With Images Nigeria Money Laundering

Power Sector Fraud Efcc Investigates Collusion To Dupe Ibadan Disco With Images Nigeria Money Laundering

Ag S Office Warns That Unemployment Fraud Can Result In Prison Time The Lebanon Voice

Unemployment Fraud State Seeks No Criminal Charges In 99 8 Of Cases

Unemployment Fraud State Seeks No Criminal Charges In 99 8 Of Cases

Fraud Or Mistake Claimants Say Unemployment System Punishes Confusion

Fraud Or Mistake Claimants Say Unemployment System Punishes Confusion

Insurance Fraud In Nevada How People Get Nailed For It

Insurance Fraud In Nevada How People Get Nailed For It

Looking For Real Justice Felony Charges Detroit Wayne County

Looking For Real Justice Felony Charges Detroit Wayne County

Prosecutors To Announce Felony Charges In Unemployment Fraud On Thursday Klas

Prosecutors To Announce Felony Charges In Unemployment Fraud On Thursday Klas

10 People Facing Felony Charges Related To Unemployment Insurance Fraud

10 People Facing Felony Charges Related To Unemployment Insurance Fraud

Colorado Unemployment Insurance Benefits Fraud Lawyer Warns Explains Criminal Prosecution Denver Colorado Criminal Defense Attorney Denver Colorado Criminal Lawyer

Colorado Unemployment Insurance Benefits Fraud Lawyer Warns Explains Criminal Prosecution Denver Colorado Criminal Defense Attorney Denver Colorado Criminal Lawyer

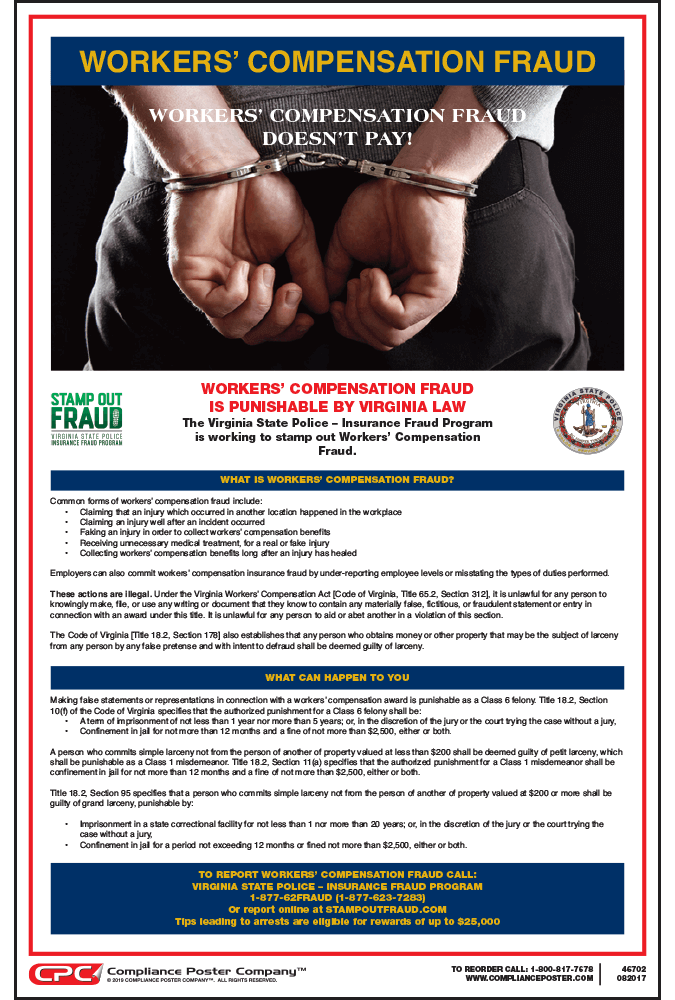

New Virginia Workers Comp Fraud Poster Now Available Compliance Poster Company

New Virginia Workers Comp Fraud Poster Now Available Compliance Poster Company

Post a Comment for "Is Unemployment Insurance Fraud A Felony"